The $40 billion reset

Capital is flowing, franchises are multiplying, and participation is surging. But India's sporting infrastructure is being constructed in real time — and the gap between commercial momentum and institutional readiness has never been wider.

Global sport sits at an unusual crossroads. The market has never been this valuable — $417 billion today and projected by Kearney to hit $602 billion by 2030. Yet beneath the surface (like a duck paddling furiously), the industry is in flux. Power is shifting, money is multiplying, and the rules are being rewritten in real time.

The forces reshaping it are both disruptive and deliberate. In golf, Saudi Arabia’s sovereign Public Investment Fund (PIF) has poured nearly $5 billion into LIV Golf, upending one of sport’s oldest hierarchies. The PGA Tour recently rejected a $1.5 billion reunification offer from the same fund. Elsewhere, PIF-backed football clubs have been lobbying to enter UEFA competitions — and I’ll stick my neck out here — it will happen. When it does, football changes forever.

That restlessness is visible closer to home.

Indian sport is navigating the same turbulence—capital flooding in, structures stress-tested, power centres shifting. But here, the stakes are different. This isn’t a mature market being disrupted; it is an emerging market consolidating while expanding. Growth and fragility are happening at the same time. The $40 billion question: can India build a lasting sporting economy, or is this just another cycle with better branding?

Momentum

Cricket’s commercial engine is evolving again. Last month, Apollo Tyres replaced Dream11 as the lead sponsor of India’s national teams after the government banned online real-money gaming. The men’s twin ICC titles — the 2024 T20 World Cup and the 2025 Champions Trophy — restored their dominance, while the transition from Virat Kohli and Rohit Sharma to Shubman Gill represents more than just a captaincy change. It signals a generational shift in leadership, commerce and cultural machinery.

Indian football is recalibrating, too. The Supreme Court recently approved a new constitution for the All India Football Federation – a technical change, but crucial if the sport is to modernise. It won’t happen overnight, but the direction is right.

But none of this will slow the growth ahead.

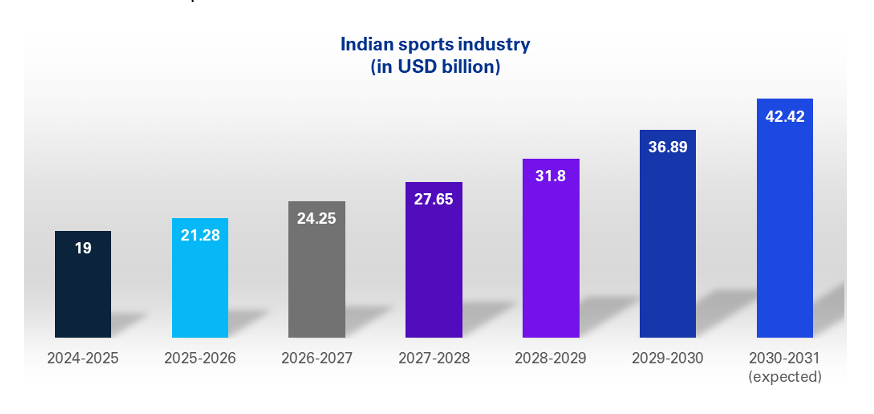

India’s sports economy is valued at $19 billion.KPMG India projects it could hit $40 billion by 2030, growing at 12-24% annually. The sector already supports close to five million jobs, with that number expected to double over the next decade. The opportunity is vast — the space in which the next decade of growth will unfold.

Much of this growth trajectory is driven by media rights. The Indian Premier League’s (IPL) Rs 48,390 crore (~$6 billion) broadcasting deal — awarded to what were then Disney-Star and Viacom18, now merged under Reliance-Disney — fundamentally reset expectations for what Indian sport properties could command. KPMG also estimates that franchise valuations across India’s major leagues—from cricket to kabaddi to football and beyond—are rising by roughly 25% annually.. The $18 billion IPL remains the anchor (and within it, the escalation has been stunning). The Royal Challengers Bengaluru’s owners are reportedly seeking a $2 billion valuation for a potential sale, an asking price that highlights both the scarcity of available teams and the depth of investor appetite. Yet the growth now extends well beyond cricket, as capital and audiences begin to diversify across a broader sporting marketplace.

The idea that cricket monopolises sport won't hold much longer. Men’s cricket still anchors the ecosystem — economy and audience alike — but the orbit around it is expanding fast. If the Indian women’s cricket team were to win the ongoing Women’s World Cup (or even get close), it could be Indian sport’s 1983 moment all over again — propelling women’s sport from niche into mainstream permanence.

Legacy sports are experiencing their own revival. Kabaddi has built a mass audience through the Pro Kabaddi League. Hockey retains its cultural resonance (and is quietly re-emerging). India is cultivating new champions in fields that previously dwelled on the fringes — chess, athletics, javelin.

Meanwhile, newer imports such as padel and pickleball are capturing younger, urban audiences. Investment data is still limited, but participation is growing. Distance running, once a niche pursuit, now commands nearly a quarter of all non-cricket sponsorships (a quiet revolution in participation-led sport).

Policy, of course, moves more slowly than markets. But it is moving. The National Sports Governance Act, 2025 and the new Khelo Bharat Niti (National Sports Policy), 2025, represent India’s first serious attempt to replace personality-driven administration with institutional frameworks. Yet the Supreme Court recently observed that several national federations remain “ailing.” The gap between legislative intent and operational reality remains wide.

While regulations crystallise, a parallel ecosystem is quietly taking shape. Sport and technology are blurring together. GPS-embedded sports vests, AI-driven performance analysis (or player scouting), personalised training algorithms, health-optimisation tools. Sneaker culture has found its footing. Smartwatches have moved from novelty to necessity. Startups like Ultrahuman, DreamSetGo, KheloMore, and Hudle are building India’s sports-tech layer.

It all feels familiar — the messy, high-velocity energy of India’s startup ecosystem circa 2015. Back then, the market ran on conviction more than structure. Same thing here. There will be missteps, collapses, and corrections. But there will also be outliers that define the next decade.

We are watching the coming of age of Indian sport. It is developing its own capital cycles, talent pipelines, and economic logic. What was once a cultural sidebar is now a marketplace in motion.

What was once a cultural sidebar is now a marketplace in motion.

Endurance

India’s six medals at the 2024 Paris Olympics — none of them gold — exposed the gap between commercial momentum and competitive depth. Elite performance is still brittle, built on individual brilliance rather than systems. Capital is flowing, franchises are multiplying, and participation is widening. But the pathways from grassroots to podium are under construction.

Suppose India secures the 2036 Olympic Games (or even the one after). In that case, the real test won’t be infrastructure — it will be integration: aligning policy, investment, participation, and governance into a system that sustains excellence, not just hosts it.

The media landscape has narrowed considerably. The Reliance-Disney merger consolidated Star, Hotstar, JioCinema, and Viacom18’s sports assets under one entity, reducing competition for rights. The IPL deal was struck in a multi-bidder environment; future renewals may not enjoy the same tension. If media rights growth stalls — or plateaus — franchise valuations could come under pressure. The following rights cycle, in 2027, will test whether commercial logic is durable or contingent.

The outlines of an industry are everywhere — leagues, academies, media rights, and investors. Beneath the surface, the harder task is endurance. Indian sport has learnt how to move fast; now it must learn how to last.

Indian sport has learnt how to move fast; now it must learn how to last.

The aeroplane is being flown while it is being built. And for once, everyone wants a seat.

That’s all for today.

If you’ve got thoughts, tips (the info kind, not the money kind), or things you think I should be paying attention to — reply here or reach me at venkat@stateofplay.club.

See you next week.